For many businesses, moving money around can involve a significant cost, both financially and in terms of the work involved. Whether it is reimbursing staff for expenses they incur as part of their role or transferring money to international partners, it is essential to make these payments accurately and on time, and to have a complete audit trail.

Luckily, there are many digital platforms available that can streamline these processes and create efficiencies in workflows, saving time and money and reducing the risk of errors. Equals Money is one of these platforms, but there are many others available, too. In this article, we will look at the features of Equals Money, explain why you might want to look at other options as well and provide six alternatives to consider.

Features of Equals Money

Equals Money is a UK-based payments and expense management platform that supports small- and medium-sized businesses. Its aim is ‘money movement made simple’ and it helps organisations with:

- Managing staff expenses: physical and virtual corporate cards, timely reimbursement to staff and cost control through spending limits.

- International payments: faster currency exchange and multi-currency business accounts to minimise exchange costs.

- Budget control: tools enable companies to maintain a detailed, up-to-date overview of their spending and avoid unexpected extra expenses.

- Compliance: the system provides an automatic audit trail of spending, where and by whom.

Why UK Employers Look into Equals Money Alternatives

Equals Money is a robust system for currency exchange and expense payments. However, choosing the right payment and expenses platform for your business involves focusing on your priorities and ensuring that the investment you make now will support your future plans. Many UK businesses look into alternatives to Equals Money for the following reasons:

-

-

Scalability: a growing business may need a platform that centralises expenses and payments with other functions such as payroll, HR or advanced financial reporting.

- International growth: businesses with global operations may need more favourable conversion fees or currency coverage.

-

- Integrations: organisations may look for systems that support greater integration with financial and resource planning systems.

- Higher than expected fees: for some businesses, the fees associated with the payments can accumulate to considerable amounts, making alternatives that offer a reduction on these costs an attractive proposition.

Top 6 Equals Money Alternatives

Many alternatives to Equals Money exist. Here we’re providing six strong options to consider if you are looking to invest in an expenses and payments platform for your UK-based business.

Equals Money Comparison Chart

To support your research into Equal Money alternatives, we’ve provided this easy-to-use table, which can guide your thinking.

| Platform | Best For | Key Features | Pros | Cons | Price |

| Factorial | Growing SMEs that want to centralise their workflows | Expense management, payroll, time tracking and HR tools | All-in-one platform, UK-compliant | Complex system, if you only need expenses | From £5.40 per user per month |

| Pleo | Smart company credit cards | Prepaid cards, receipt capture | Easy set-up and intuitive interface | Higher cost | From £9 per user per month |

| Spendesk | Growing businesses | Company credit cards, invoice management | Good for larger teams | Complex system for smaller businesses | From £9.50 per month |

| Wise | Low-cost international payments | Multi-currency accounts, low-cost transfers | Trusted global brand, transparent foreign exchange rates | Limited cash withdrawals | Free to register, transaction-based fees |

| Revolut | Digital banking and multi-currency accounts | Corporate cards with spending limits | Easy-to-use interface | Limited budget allocation tools | From £8 per month |

| Airwallex | Companies expanding internationally | Global multi-currency accounts | Competitive foreign exchange rates | Limited expense tools | A variety of plans are available |

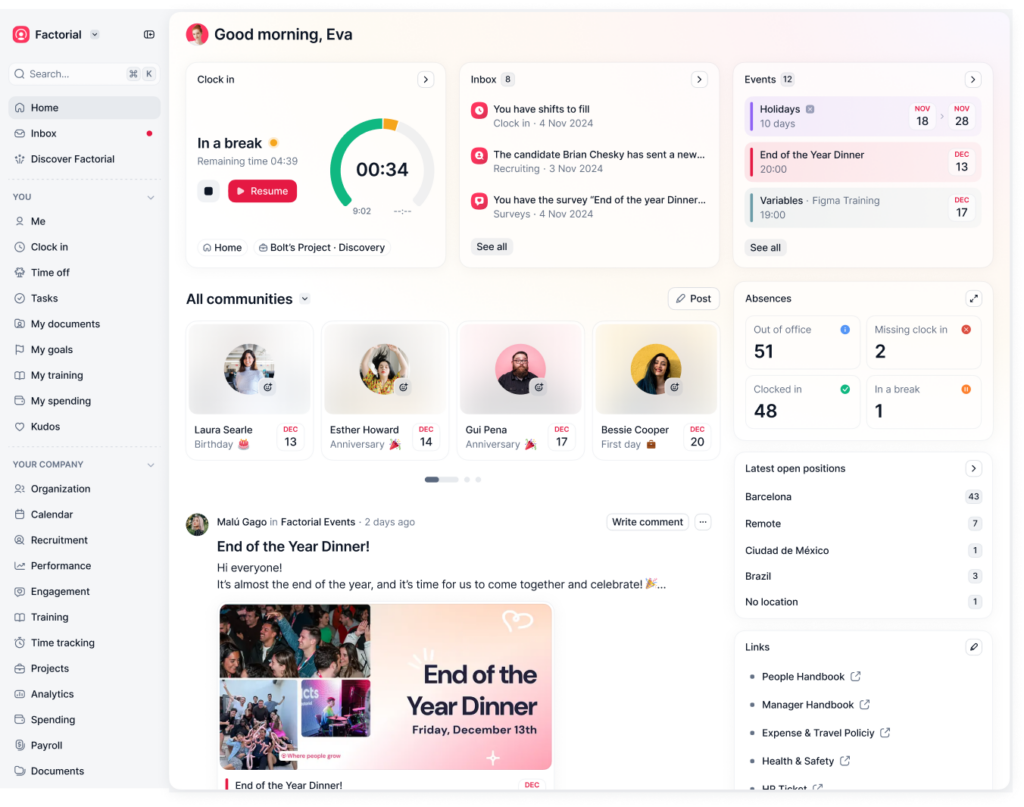

1. Factorial – Best All-in-One Business Management Platform

If you are looking for a platform that will help you centralise a number of the daily functions involved in running a successful SME, Factorial is a robust business management system that will streamline your expenses and payments while also supporting your workforce through scheduling and leave planning, performance management and learning and development.

Key features of Factorial:

- The expenses module enables the upload of receipts via an OCR scanner, which automatically categorises expenses. It also supports virtual and physical credit cards that can be preloaded and allows setting pre-determined spending limits.

- AI tools support the creation of detailed, customised reports to provide insights into company spending patterns.

- Time tracking and payroll are integrated with expenses to ensure payments to employees are accurate and fair.

- Wider HR tools, including performance reviews, onboarding workflows, checklists, and document management.

- A native mobile app that enables employees to upload receipts and access expense and salary information from anywhere.

Pros:

- User-friendly interface makes onboarding quick and easy.

- UK-specific compliance features.

- The centralised system combines finance, compliance and HR support in one tool.

Cons:

- As the platform covers more than simply expenses, it can feel complex to navigate.

Price:

- Factorial’s plans start from £5.40 per user per month.

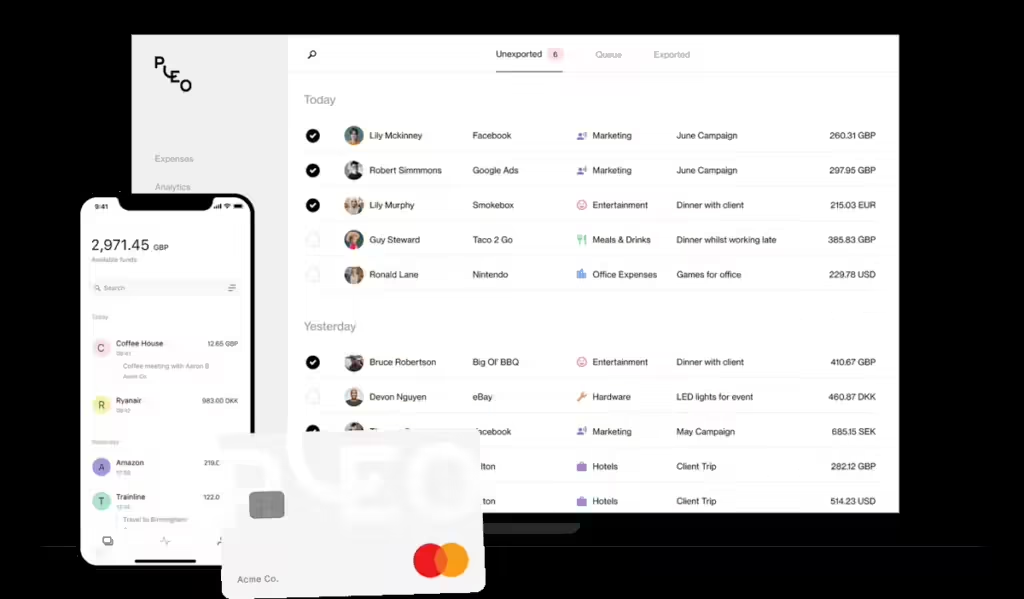

2. Pleo

Pleo is a popular expense management option in the UK, making it a strong Equals Money competitor. It offers prepaid smart cards to help control expenditure and real-time expense tracking, so organisations are aware of their outgoings at any point in time. However, Pleo’s restricted customisation options, lack of global reach, and limited support for expense management can lead many companies to seek alternatives.

Key Features of Pleo:

- Smart company cards with spending limits and tracking.

- Automated receipt capture.

- Support for different currencies.

- Virtual dashboard and downloadable reports for data-driven company insights.

Pros:

- Quick and easy onboarding.

- Integrations with accounting systems such as Xero and QuickBooks.

- Intuitive mobile app.

Cons:

- It can be an expensive option for the limited services it provides.

Price:

- Free trial.

- Prices start from £9.50 per user per month for a minimum of three users.

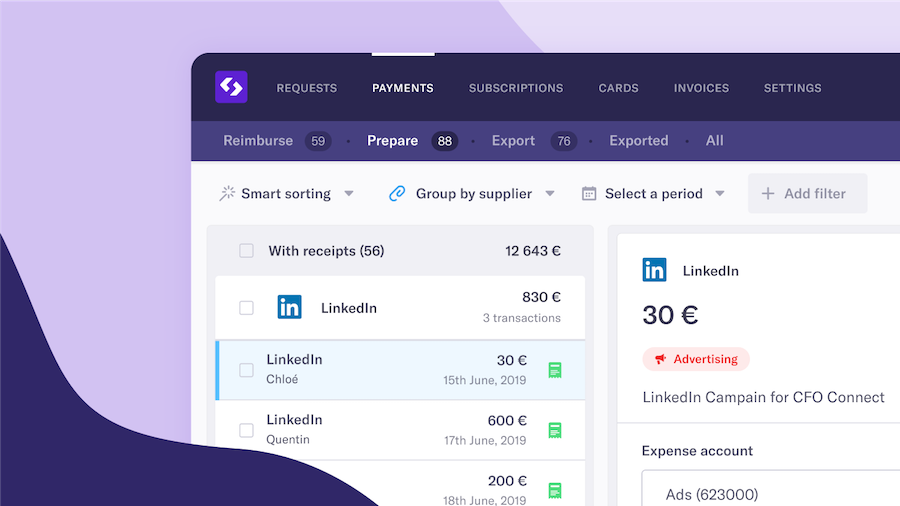

3. Spendesk

Spendesk is another popular expense management platform, one that is designed for European companies that are scaling their operations and need payment tools that will support the changing demands of their business. With its four different plans, Spendesk offers options that provide varying levels of payment support tailored to your budget and needs. If you are looking for systems to provide support beyond expenses, consider alternatives to Spendesk.

Key Features of Spendesk:

- Company cards with spending limits

- Invoice processing and customisable approval workflows.

- Email receipt capture.

- Includes tools for mileage claims.

Pros:

- Integrates with financial applications and HR systems.

- Robust system for centralised finance control.

- Provides visibility across multiple teams.

Cons:

- It can be a complex system for small businesses

Price:

- Four different plans available: Starter from £9.50 per month for three users, to Essential (£39 per month), Advanced (£89 per month) and Beyond (£179 per month).

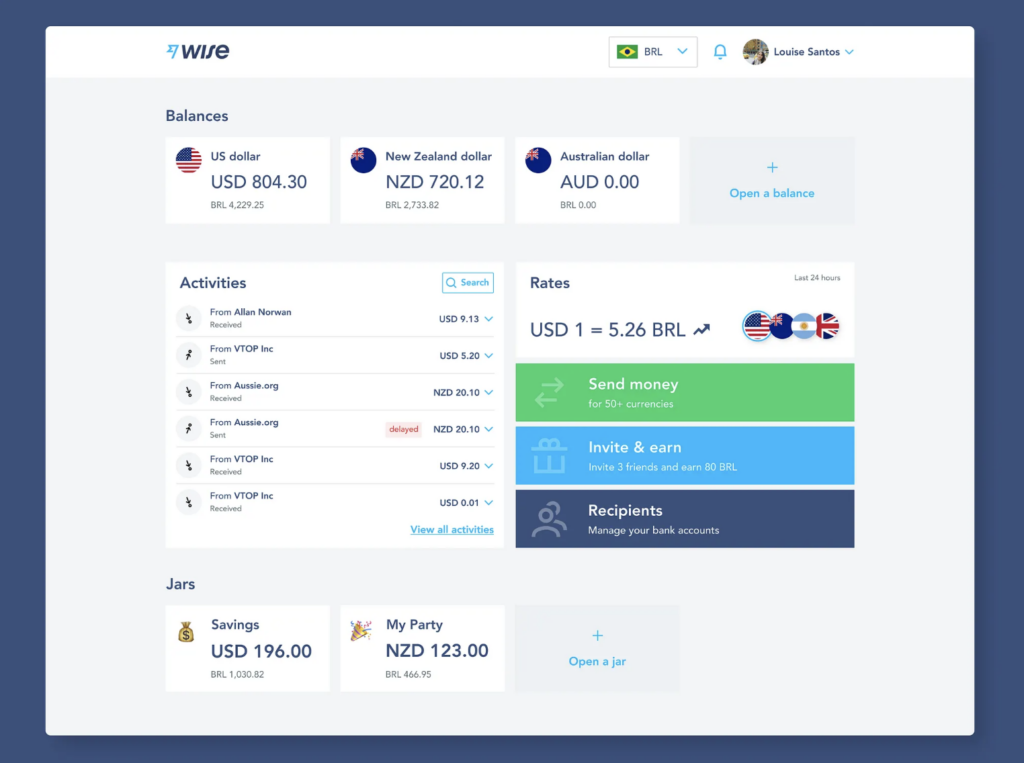

4. Wise

Formally known as TransferWise, Wise is a leading global payment solution which is known for its multi-currency accounts and low-cost international transfers. It offers a prepaid Mastercard company credit card, which can be virtual or physical and supports 40 different currencies. Wise regularly features on lists of the best business cards, but if you are looking for support beyond a simple credit card for your team members, then other expense management systems may be better options.

- Centralised approach to managing company credit cards.

- Multi-currency business accounts.

- Transparent and low-cost international transfers.

- Ability to make batch payments for specific suppliers and payroll.

Pros:

- Offers some of the best exchange rates.

- Efficient and helpful support team.

- Integrates with financial software such as Xero and QuickBooks.

Cons:

- Limited cash withdrawal options.

Price:

- Free to register and get a card, then low fees per transaction.

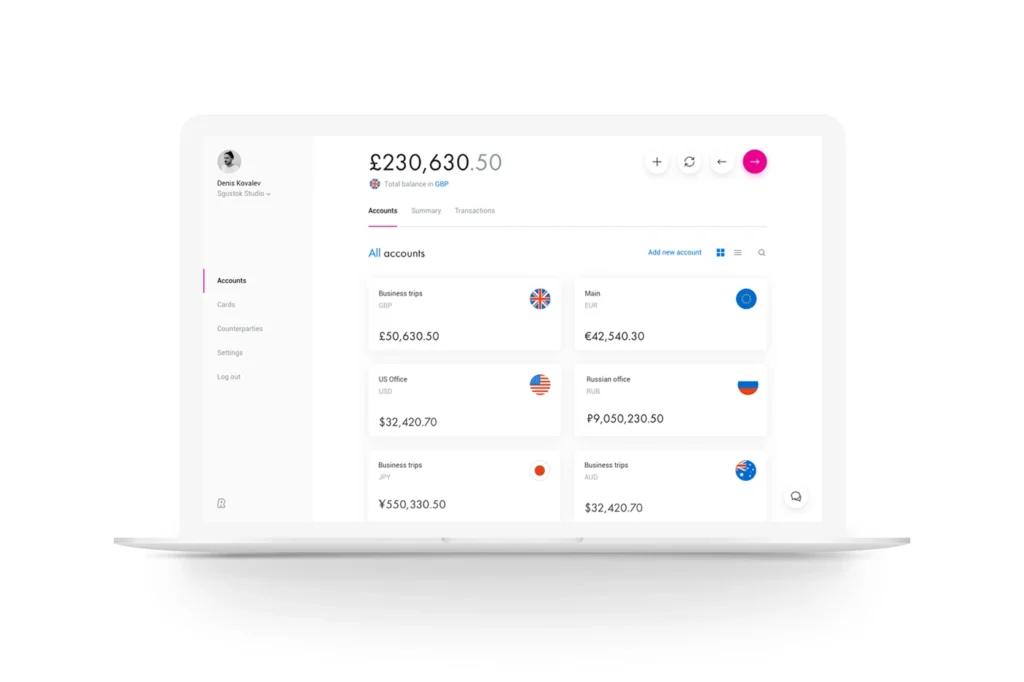

5. Revolut

Revolut is a UK-based platform offering business and personal accounts that support digital banking, international money transfers, invoicing and travel perks such as fee-free spending abroad and travel insurance. It is often considered one of the best company credit cards for small businesses, offering physical and virtual corporate cards that you can customise depending on what restrictions you need. Revolut offers a competitive rate for over 30 currencies, so it’s a popular choice for companies with global operations.

Key Features of Revolut:

- Virtual and physical company cards with spending limits.

- Multi-currency accounts.

- Automatic receipt matching and categorisation.

- Customisable approvals.

- Integrates with leading accounting platforms like QuickBooks and Xero.

Pros:

- Supports multiple currencies.

- Intuitive interface on mobile and web platforms.

- Includes perks such as fee-free travel and travel insurance.

- Prevents overspending.

Cons:

- Limited budgeting tools can make it harder to allocate expenses correctly.

Price:

- Four plans are available, starting with Basic at £8 per month, progressing to Grow at £30 per month, and then to Scale at £90 per month. An Enterprise plan is available at a custom price.

6. Airwallex

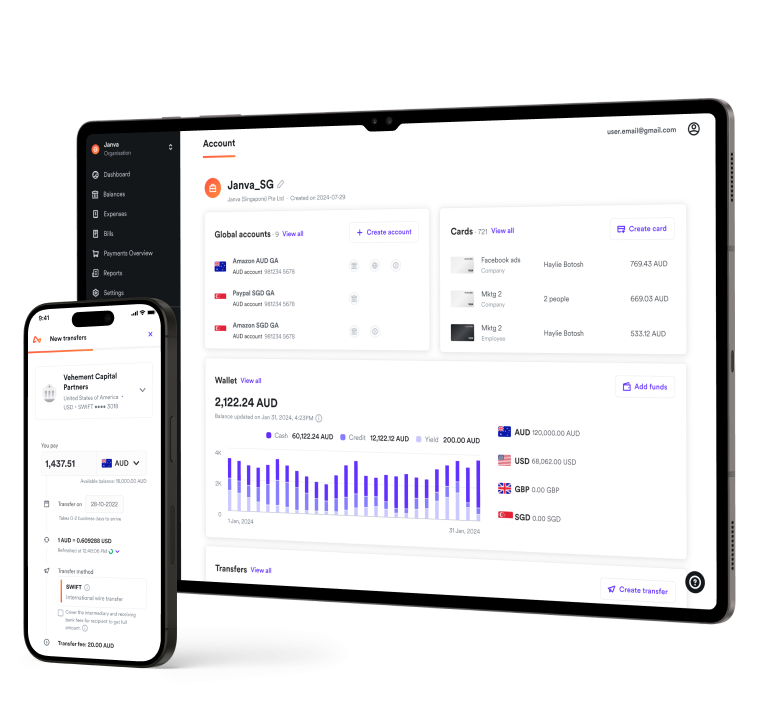

Operating globally since 2015, Airwallex is a software platform that covers expense management, international transfers and business accounts in many different locations. Specifically designed to support fast-growing businesses that need support with international payments as they expand into new regions globally, Airwallex offers reasonable rates on international transfers.

Features of Airwallex:

- International money transfer

- Receipt uploading and expenses approvals.

- Physical and virtual company cards.

- Strong integration with other applications such as Xero, QuickBooks and Shopify.

Pros:

- Competitive rates for international transfers.

- Supports multi-currency accounts with over 60 currencies.

- Paperless set-up facilitates quick onboarding.

Cons:

- Physical cards can be limited in functionality, eg, issues using ATMs for withdrawals.

Price:

- Plans range from up to £19 (Explore), £45 (Grow) and £999 (Accelerate) per month, depending on your requirements and the complexity of your business.

- Includes a free plan with a minimum monthly deposit.

Choosing the Best Equals Money Alternative

Choosing the best Equals Money alternative depends on your budget, your current and future business requirements and other factors such as whether you want a centralised system that supports more than simply expense management. It’s a good idea to spend some time thinking about the priorities for your business to ensure that you are investing in the right platform.

👉 Book a free demo today! See how Factorial can support your expense management and simplify your HR workflows at the same time.

Factorial combines HR, payroll, and expense management in one intuitive platform. Book a free demo today to see how having one centralised system like Factorial compares to having a simple expense management system like Equals Money.

The information presented on this page is based on publicly available sources and not limited to wise.com, airwallex.com, revolut.com, spendesk.com, pleo.io, equalsmoney.com, G2 public reviews, Capterra public reviews, and trustpilot public reviews. The comparisons between Factorial and other providers, are intended solely for the illustration of the respective software features, pricing and functionalities. All information regarding features, prices, and integrations may be subject to change without prior notice. Factorial assumes no liability for the accuracy, completeness, or timeliness of the information presented. We recommend contacting the respective providers directly to obtain the most accurate and up-to-date information. All legal regulations regarding spanish fair advertising and competition law are fully observed by us; if you have any concerns, please reach out to us. The comparisons presented do not constitute a final evaluation or recommendation for any provider, but serve solely as an informational source.