Corporate cards for secure company spending

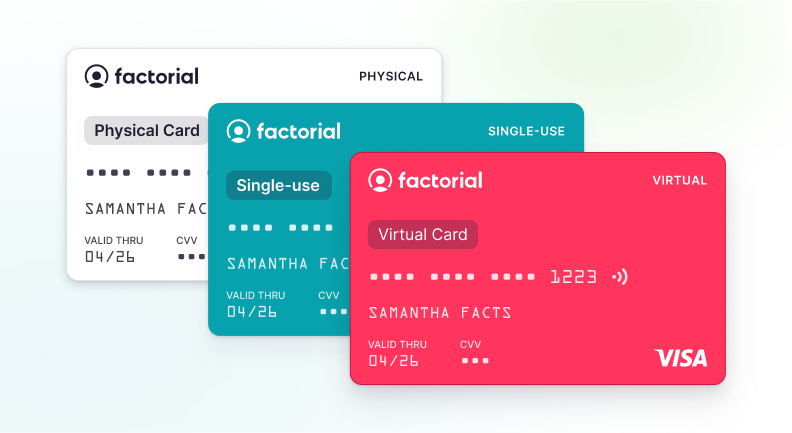

Take charge of your company's spending and forget about manual expense reimbursements thanks to our corporate credit card - available in both virtual and physical formats.

The business expense card that does it all

Pay securely, manage spending with greater flexibility and gain complete financial control with Factorial corporate cards.

Set limits

Create different cards for each purpose and modify the budget on each for greater control over spending.

Automate expenses

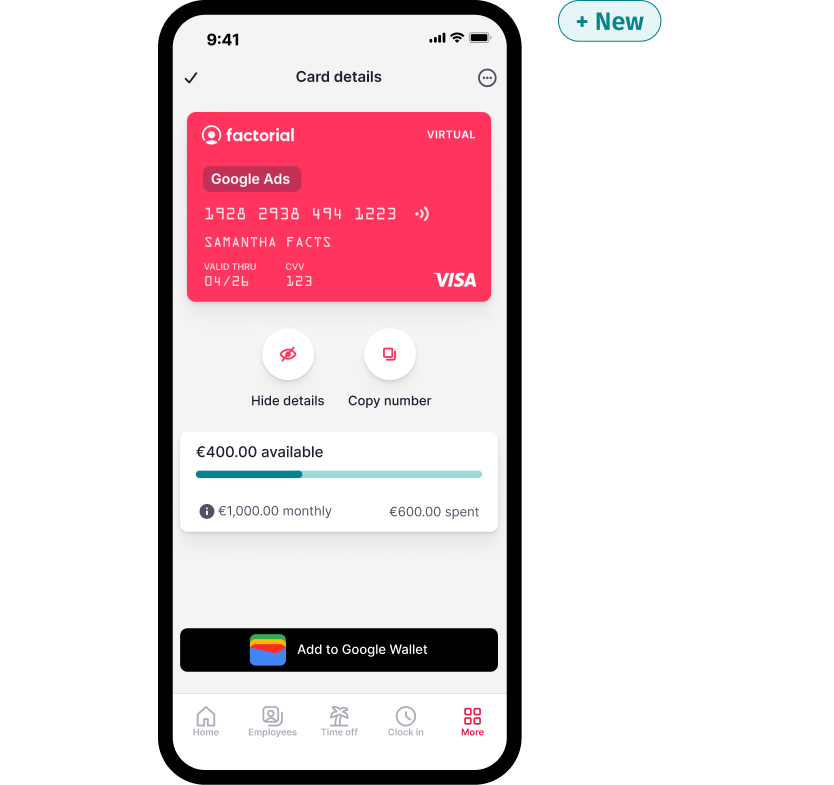

Say goodbye to paper expense claims and piles of receipts. Instead, get notified instantly about each expense and review via mobile app.

Adjust instantly

Temporarily freeze cards expense cards for employees when they’re on leave, or cancel them at the click of a button.

Integrate with Apple

Add virtual cards for business to your Apple Wallet and pay on-the-go securely with any Apple device.

Pay securely

Feel safe making purchases knowing that our employee expense cards have unique numbers that are never stored on our servers.

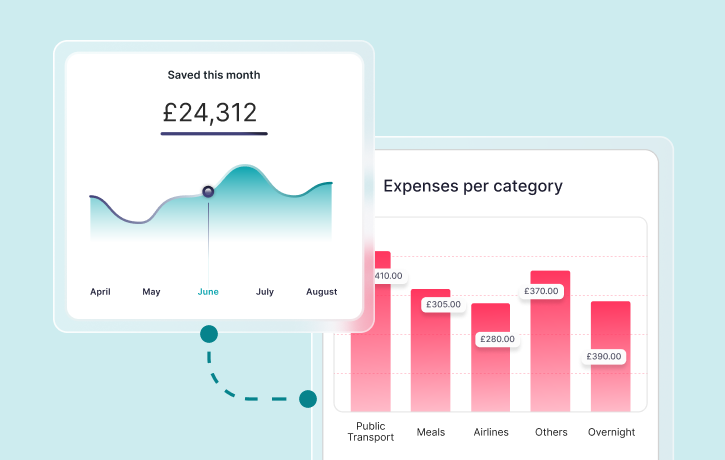

Gain insights

Integrate with our HR Analytics tool for deeper insights into spending so you can control costs more effectively.

The impact of an expense management system

Join the companies worldwide already optimising their expense processes with Factorial.

10 mins

Less spent per expense ticket

27 hours

Saved on average per month

+500

Companies using our expense management solutions

Stay on top of spending

Centralise expense processes for total visibility and control over business expenditures.

Pay easily and quickly

Empower team members to pay painlessly with an employee credit card and adjust settings flexibly for ultimate business agility (Including Apple pay).

Activate your corporate cards in just 4 steps

Equip your team with their own business expense card with customised settings

FAQs about business credit card UK

Find answers to the most commonly asked questions about business expense cards for employees here.

What is a corporate credit card?

A corporate credit card is a financial tool that allows businesses to make purchases and manage expenses. It is issued in the business's name and is separate from personal finances.

How does a corporate credit card work?

A corporate credit card works by allowing employees to make business-related purchases on behalf of the company. The company is then responsible for repaying the credit card issuer.

Why should I use a corporate Visa card?

Using a corporate Visa card can streamline expense management, provide a clear record of business spending, and offer benefits like rewards programmes and purchase protection.

What types of corporate cards Factorial can provide?

Factorial can provide various corporate cards, including credit cards tailored for business expenses, travel cards for employee trips, and purchasing cards for procurement purposes.

Who can apply for a business credit card with Factorial?

Any business entity, including small businesses and larger enterprises, can apply for a business credit card with Factorial.

What are business credit card integrations?

Business credit card integrations refer to the ability to connect credit card transactions with accounting or expense management software, streamlining the tracking and reconciliation of business expenses.

Do corporate cards have a limit?

You can set a spending limit with Factorial's corporate cards. Even customise company spending limits based on employee or per day, depending on your needs.