Companies are looking for simple ways to minimise their corporation tax, one of which is claiming allowable business expenses, otherwise known as limited company expenses. The total cost of these expenses can be deducted from your overall income before profit is calculated, leading to a lower corporation tax.

However, expense management and reporting can be a minefield of regulations, exceptions and nuances. HMRC have specific rules about what qualifies as a tax deductible expense. Tax rules on allowable expenses then vary depending on the category of expense or benefit. This means all limited company expenses must be reported to HMRC to review.

This might leave you wondering, what are allowable expenses for employees? What is tax deductible? What should you avoid? How can you implement an expense policy and expense log? How do you report tax deductible expenses to HMRC?

In this ultimate guide, we will untangle the complexities and navigate the minefield of business expenses.

Allowable Limited Company Expenses

Let’s start with the basics. First and foremost, you need to know what falls into the category of tax deductible expenses in the UK. The line between allowable business expenses and disallowable expenses can be thin, so it’s best to know your stuff.

Expenses can be split into two overarching categories which qualify for different forms of tax relief. The first and more typical is revenue expenses, under which falls short-term expenditures that aid the daily operational runnings of a business. The second is capital expenses, which usually involve a larger spend and longer period of benefit. If you’re ever in doubt, you can use gov.uk’s handy toolkit for clarification.

One rule remains the same across both categories: whatever is expensed must be ‘wholly and exclusively for the purposes of the trade, profession or vocation’. Some examples of allowable limited company expenses include:

- Office operational costs (stationery, equipment, phone bills).

- Office rent and utility bills.

- Accommodation and travel costs for business trips.

- Staff salaries.

This list is not exhaustive by any means, but gov.uk’s a-to-z of expenses and benefits delves into more detail about each expense category, including what you need to report and what is exempt.

Disallowable Expenses

On the other hand, disallowable expenses are things you pay for that are excluded from tax relief. You can incur HMRC penalties if you incorrectly claim these as a tax deduction.

Expenses can often be related to your business whilst also having a personal element to them. For example, an employee might use their home telephone for both private and business calls. They cannot expense their entire phone bill. However, they can establish what percentage of the bill is resultive of business calls and can expense this.

This is a common stumbling block for businesses. If a distinction between business and personal within the cost can be made, then the business element can be expensed. If not, then HMRC will not deem it allowable. The following personal expenses are similarly disallowable:

- Political or charitable donations.

- Loan repayment (if taken out personally for the business).

- Business entertainment.

Although entertainment doesn’t qualify, certain types of events are tax deductible. UK regulations stipulate that a business can expense an event as long as it fits the following criteria:

- It’s an annual event.

- It’s open to all employees.

- It costs less than £150 per head.

So rest assured, your office Christmas party is saved.

Working from Home Expenses

Now that an increasing number of companies are offering hybrid and remote work opportunities to their employees, more and more employees are incurring expenses related to home working. This might include WiFi, home office equipment, phone bills and utility bills.

For this reason, more employers are including working from home expenses in their expense policies. This requires employers to collect receipts and invoices detailing these expenses, or to directly pay their staff a working from home allowance.

There is no legal obligation for employers to do so. They can, however, suggest that employees working from home claim tax relief for these household costs. This is only possible if the employee in questions works remotely because their job requires them to live a substantial distance from the office or their employer doesn’t have a workplace.

Creating a Clear Employee Expense Policy

Creating and communicating an employee expense policy to your workforce is the key to avoiding misreporting and accounting issues. Your employees should know which expenses they are allowed to claim, any upper limits on these, how to claim and accurately report them and how they’ll be reimbursed. You also need an accurate expense log and record-keeping system on your end so that you can track your total limited company expenses throughout the year.

Defining your guidelines and procedures is the first step. Building these strong foundations will give employees something to reference whenever there is confusion about a specific cost. This policy should cover:

- Expense types that qualify, with examples.

- How to request reimbursements. (Download our free template above)

- Any deadlines for request reimbursements.

- Supporting documents that need to be included in the requests, such as receipts or invoices.

- Approval manager for reimbursement requests.

- Upper spend limits for each expense category.

- List of suppliers that your employees should use for each category.

- Process for reimbursement. (How and when)

- Consequences of expense fraud and overspending.

Once this policy is in place, ensure that your workforce is made aware of it and that any future tweaks are communicated to them. It should be easy to access for all employees.

Finally, remember to always ask your employees for receipts. A paper trail is important for reimbursement and reporting.

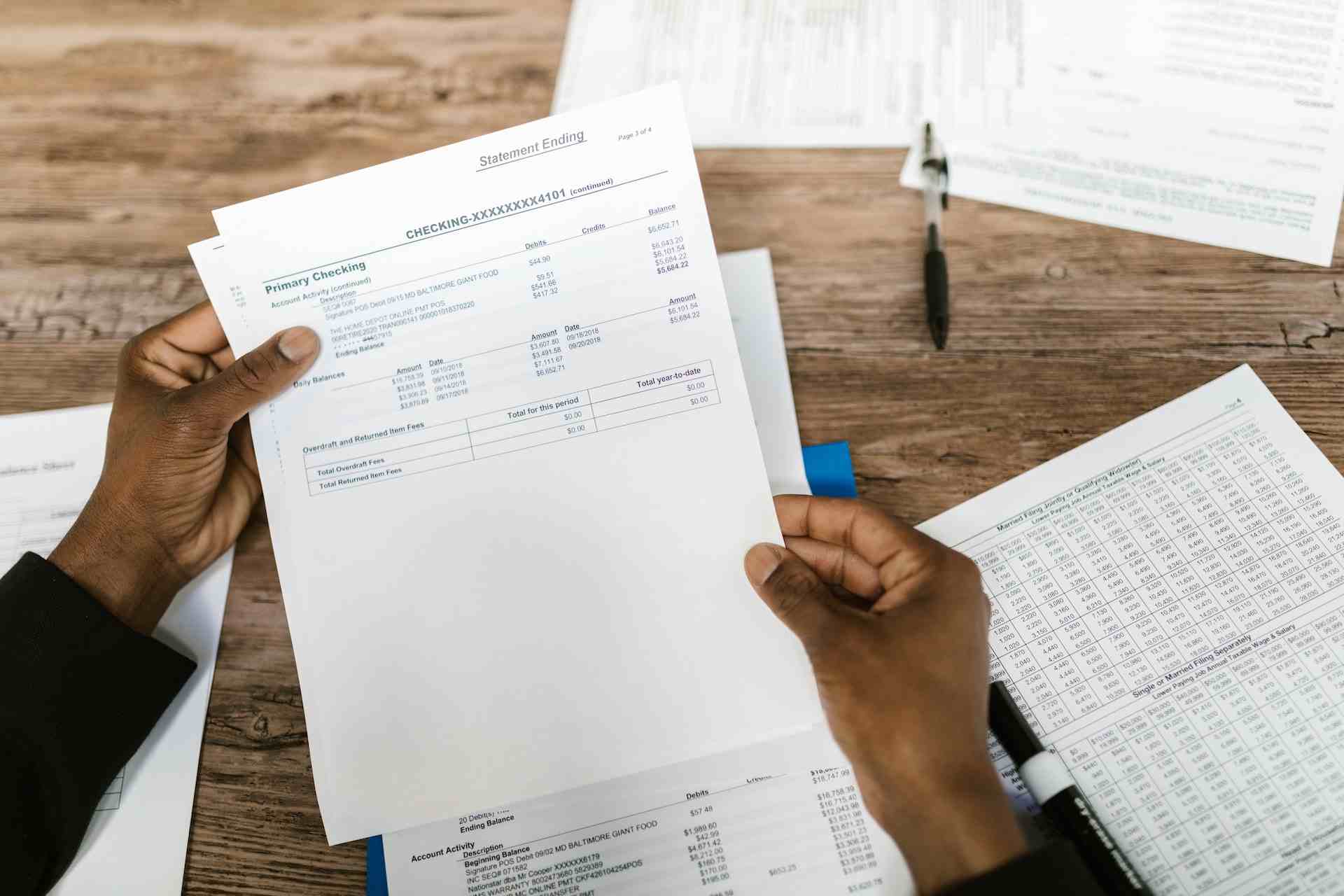

Keeping an Expense Log

Make sure you create a clear and standardised process for submitting claims. Having this in place will help to build an accurate record of your limited company expenses and avoid potential HMRC fines.

You have three options to choose from here. You can create a standardised template to gather all the information you need for each claim. However, this method can lead to additional work and is more likely to result in inconsistencies through human error.

Hiring third-party agents such as accountants is a more reliable method and can save you time to focus on the things that really matter, like team management and job enrichment. It might also give you peace of mind to have advice from a professional trained specifically in tax. However, this all comes at a cost, and one that’s much higher than running your own expense log.

A much more effective way to standardise your requests is by using expense management software. Doing so makes it a lot easier for you and your workforce to track business expenses.

Another benefit is that employee expense requests are automatically sent to the allocated expense manager for them to accept or reject.

Utilising expense management software also centralises your expenses so that all your data is accessible from one place. This makes it easier to process high volumes of reimbursement requests from different teams within your company. Future you will be thankful, too, as this makes setting up payroll and applying taxes more straightforward.

Not to mention that both you and your workforce get a clearer user experience. Employees can see the status of their requests from their own dashboard. This means less time spent dealing with status update requests and fiddling with excel spreadsheets.

No matter which option you choose, remember to keep all expense records for a minimum of six years after your tax return has been sent. HMRC reserves the right to investigate your reported limited company expenses within this time period and to fine you for any discrepancies or missing records.

Paying Expenses Through Payroll vs. End of Tax Year

Any tax deductible expenses need to be reported to HMRC, either through payroll or at tax year-end. Any Class 1A National Insurance you owe on these expenses will also need to be reported and any outstanding amount will need to be settled.

The process is a bit simpler if you have been paying expenses through payroll. You still need to report any National Insurance owed via a P11D(b) form, but you don’t need to report expenses at the end of the tax year. If this process, called ‘payrolling’, sounds like the preferable option to you, you can register to do so before 6th April each year.

Another option is reporting your allowable business expenses at the end of the tax year. You must report any National Insurance owed via a P11D(b) form in the same way, but with the addition of an individual P11D document for each employee that has expensed costs.

These reports can be made online or by post, although correcting errors must be done with a P11D or P11D(b) form by post. Penalties can be issued for inaccuracies on your tax return, even if they are not deliberate.

Manage Expense Requests, Records and Reports with Factorial

Limited company expenses can be difficult to manage, but using the right tools and software can help to facilitate your expense policy and create a streamlined process for managing your expense requests, records and reports.

For example, with Factorial’s expense management software solution:

- Employees can automatically upload their expenses and receipts and classify expenses according to categories.

- Managers can review expenses in their own time and accept or deny reimbursement requests.

- HR or finance can automatically generate expense reports, filter expenses and gain valuable insight into where money is being spent.

Having these tools all in one place makes it much easier for you to track and manage your employee expenses. The software gives you increased visibility and data to improve the accuracy of your expense reporting so that you don’t lose out on when it comes to tax.

It gets even better. We’ll soon be launching our Factorial Card, a corporate expense card that your employees can use to manage their expenses and benefits. Each payment they make with the card will automatically record in the app, so the administrator can approve or reject the request instantly.

You’ll be able to integrate our Factorial Cards with our expense management software, streamlining your expense processes further and saving you time and headaches.

Check out this video on our YouTube channel to learn more about how our all-in-one solution can help you create a simple and accurate expense management process.