Let’s start with the most common question: is severance pay the same as redundancy pay? In some ways, yes. Both are a form of financial settlement for departing employees. But there is a distinction between the two and, as an employer, it is important that you understand this. This will help ensure smooth operations, happy employees and legal compliance.

In this post, we will define severance pay and redundancy pay, the differences between them, who is entitled and how it works. We will also discuss some of the laws surrounding severance payment packages in the UK, and how to calculate an employee’s severance pay.

What is Severance Pay UK?

Severance pay is a form of compensation paid to an employee on the early and unwilling termination of their contract. It applies when an employee is dismissed through no fault of their own. For example, if they have been removed from a position due to company restructuring or if their employment is “severed”.

A severance payment isn’t a legal requirement in the UK, so companies that offer it gain a competitive advantage. Through their willingness to provide safety to their employees, they will attract and retain more talent in comparison to those who don’t pay severance packages. Furthermore, severance agreements also protect you against potential lawsuits relating to dismissal.

What is the Difference Between Severance and Redundancy?

Severance pay and redundancy pay in the UK are both financial settlements for employees; however, for different purposes. There are times where redundancy payments and severance payments can often mean the same thing, but there are situations where that’s not the case. Severance pay is offered to an employee at the end of their employment as part of their severance package. It is a privately agreed upon amount between an employee and employer. It often includes an augmented amount to take into consideration their bonuses or shares.

On the other hand, Legal Redundancy Pay in the UK is a basic amount that you must pay an employee if you make them redundant. This amount is dictated by the law and is not a negotiated amount between employer and employee. According to the Employment Rights Act 1996, an employee is entitled to redundancy pay on dismissal when:

- their position no longer exists within the company (due to restructuring or downsizing);

- their role is no longer required at their place of work (due to outsourcing or relocation of operations); or

- the duties undertaken by an employee are no longer required by the company (due to changes in business needs).

Standard Redundancy Pay UK: What is it?

Statutory redundancy payments depend on an employee’s contract and length of service, as well as the reasons for dismissal.

A severance payment can be a larger package, including redundancy pay and any other employee payments, such as benefits and bonuses. Redundancy pay is regulated by law, but it’s up to you to negotiate severance packages within your employment contracts.

UK Redundancy Pay Package Entitlement

As an employer, when you make an employee redundant due to changes in the business (restructuring, relocating or downsizing) there are a number of things you need to consider in order to work out how the redundancy payment is calculated.

1. Proof that services are no longer needed

As an employer, you can only make an employee redundant if you can prove that their services are no longer required by the company. If you dismiss an employee due to misconduct or performance issues then they are not eligible for even the minimum redundancy pay.

2. Is your employee’s redundancy compulsory or non-compulsory?

The next thing to consider is whether the redundancy is compulsory or non-compulsory. With compulsory redundancy, you must follow fair selection criteria and ensure you don’t discriminate. You must follow “collective consultation” rules if you’re making 20 or more employees redundant within any 90-day period at a single establishment. If you don’t, an employment tribunal could decide that you’ve dismissed your staff unfairly.

If you dismiss an employee on the grounds of business changes then you must pay them a redundancy settlement if they have been with the company for a minimum of two years. You must also pay them for all accrued wages and holidays, payments in lieu of notice where appropriate, and any negotiated bonuses.

3. Implement Severance Pay Policy

As an employer, you should have a clear policy in place for how severance pay is managed in your company. Although there are no legal requirements, your severance policy will depend on your own employment contract. It should, however, clearly outline your employee’s rights regarding severance pay.

If you decide to offer an employee a voluntary severance package then you need to make sure they sign a voluntary severance agreement. This will protect you from claims of unfair dismissal. You might also want to consider including a confidentiality clause in your severance agreement template so that departing employees don’t disclose the terms of their severance package.

How Much is Redundancy Pay?

When it comes to redundancy pay, the UK law is clear. If you make an employee redundant, you must pay them a statutory redundancy settlement if they have been with you for at least 2 years.

The amount of pay they are entitled to will depend on their length of service (capped at 20 years) and age:

- 21 and under – 0.5 week’s pay for each full year of service

- 22 to 40 – one week’s pay for each full year of service

- 41 and above – 1.5 week’s pay for each full year of service

Severance pay is capped at £719 per week, with the maximum statutory redundancy payment set at £21,570. Employees made redundant before 6 April 2025 may, however, be entitled to a lower amount.

📌 Need to calculate your employees redundancy payment? Check out our Statutory Redundancy Pay Guide for UK employers.

How Much is Severance Pay?

Things are not so clear when it comes to severance payments. There are no UK-specific severance laws, therefore, there is no legal obligation to define a severance policy. However, you might want to consider doing so as it safeguards your company from potential unfair dismissal claims. A generous severance pay policy can also help attract and retain talent, especially at an executive level. As it’s not a legal requirement, it’s up to you to decide what guidelines you include in your severance policy.

Your Severance Pay UK policy may include:

- Which employees are eligible for a severance payment

- What the parameters and requirements are for receiving severance pay in the UK

- A breakdown of which benefits and payments you will include in your severance packages

- Lastly, how many weeks’ paid notice employees will receive according to the length of service

The amount an employee receives usually depends on the length of their employment and on the policies detailed in a company’s employee handbook. Generally speaking though, a severance payment usually includes payment in lieu of notice, accrued holidays, pension payments, and additional bonuses or discretionary amounts where appropriate.

Severance Pay Calculator

How you calculate a final severance payment is not written in stone. When it comes to severance pay, it is up to you how you calculate it, unlike standard redundancy pay which must follow the government guidelines detailed above.

Will you offer a severance package to all dismissed employees? Or just those at an executive level? Which benefits will you include? Whatever you decide, you need to clearly define it in your redundancy and severance policy. You also need to make sure all existing and new employees have access to the policy.

This suggested severance pay formula gives an idea of how you could calculate severance pay taking into account their loyalty and length of service:

[Employee’s weekly salary] x [Number of weeks pay you’d like to offer](Number of years of employment) = Total severance allowance

Related Video: UK Employment Law: This video explains all you need to know about Statutory Redundancy Pay and Notice Pay.

Is Severance Pay Taxable in the UK?

The good news is that your redundancy pay is tax-free up to the amount of £30k. The bad news is that other elements of severance pay are taxable in the UK. Elements such as holiday pay and overtime will be subject to the same tax as your usual income. It’s also worth noting that cash values will be applied to any non-cash benefits and this will count towards your total redundancy pay when working out what is taxable.

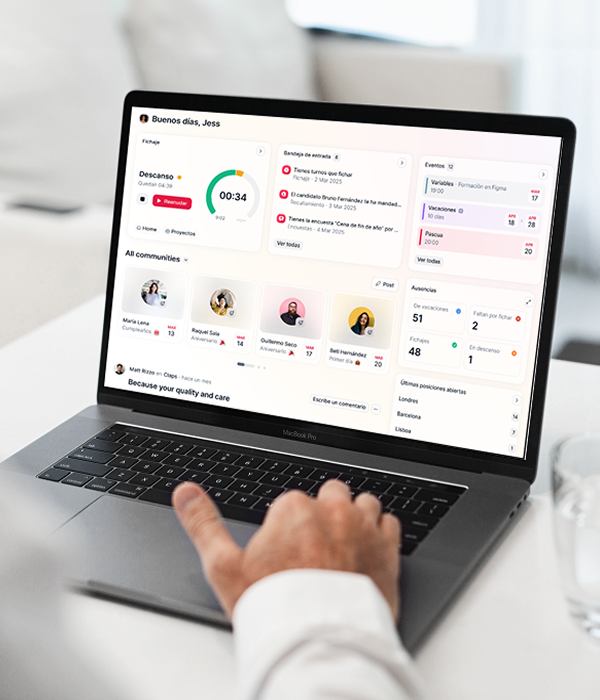

Try Factorial’s all-in-one document and payroll management software

A solid, reliable document management system can help you streamline and process your severance pay policy and procedures. Factorial’s document management feature can help you create and distribute your severance pay policy so that your employees are aware of their rights.

It can also help you coordinate a departing employee’s severance pay with payroll, tax deductions and holiday entitlement so that you can be sure that they are paid the right amount when they leave your company. The simple tool can help you boost your HR management processes. It can also help you implement a fair and robust policy for managing redundancies and severance pay at your company.

Severance Pay FAQs

What is severance pay, and who is eligible to receive it in the UK?

Severance pay, also known as redundancy pay, is a payment made by an employer to an employee who is being made redundant. Employees in the United Kingdom who have worked for their employer for at least two years are eligible for statutory redundancy pay. Employers may, however, offer enhanced redundancy pay as part of the employee’s contract or as a gesture of goodwill.

How is the amount of severance pay determined in the UK?

The amount of statutory redundancy pay an employee is entitled to in the UK is based on the length of their service, their age, and their weekly pay. The maximum amount of statutory redundancy pay is currently £17,130. However, employers may offer enhanced redundancy pay, which can be a higher amount than the statutory minimum.

Is severance pay taxable in the UK?

Redundancy pay of up to £30,000 is tax-free. Any non-cash perks included in your redundancy payment, such as a holidays or accomodation, will be valued in cash. For tax purposes, this will be included in your redundancy pay. This might push your total redundancy pay beyond the £30,000 mark.

Can employees negotiate the amount of severance pay they receive in the UK?

Employees who have a good working relationship with their employer or who have legal representation may be able to negotiate the amount of severance pay they receive. The amount of statutory redundancy pay an employee is entitled to, on the other hand, is determined by a fixed formula, so there is less room for negotiation in these cases. Employers may provide enhanced redundancy pay as part of a voluntary redundancy package that can be negotiated on an individual basis.