When planning a business trip or event, employers have to take in account daily employee spending, accommodation and transportation. It’s crucial that UK employers understand the per diem requirements set by the HMRC, particularly the rates that are exempt from taxes.

HM Revenue & Customs (HMRC) set a per diem allowance to make this clearer for business owners. A per diem payment allows employees to expense meals, travel and accommodation whilst on a business trip. Typically, this cost is paid by the employer ahead of time or whilst the trip with a company card.

In this article, we explain what per diem, scale rate payments and meal allowance rates mean, as well as the per diem allowance for national and international travel.

What is a Per Diem?

A per diem (literally translating to ‘per day’ in Latin) is the daily allowance set by HMRC that organisations can reimburse employees for business travel expenses. They cover travel, food and accommodation, amongst other things.

As the per diem rate is fixed, they can make budgeting and forward planning much easier for employers. Per diem rates vary based on location, workplace, working day, and hours worked. HMRC updates these rates annually.

As business expenses aren’t subject to tax or National Insurance, recording and reporting per diems can save your company money and strengthen your bottom line. Bear this in mind when your employees travel abroad for work as they’ll need to keep supporting receipts.

If meal costs and other business related travel expenses surpass the rates set, employers will need to pay tax and national insurance to the internal revenue service on the additional amount.

What is an HMRC Meal Allowance Rate?

A meal allowance rate is a standardised type of per diem. People also refer to them as “scale rate payments” or “subsistence expenses.” These rates are applied to employees on business-related trips and govern the amount they can spend on meals and accommodation. The fixed meal cost varies depending on the location.

By law, the employee does not need to provide receipts specifically to prove their purchase. They do, however, need to prove that the incidental expenses were incurred while they were on a business trip for per diem rates to be applied.

The HMRC have set criteria for when these scale rate payments can be applied. Per diem rates are only applicable if:

- The employee is travelling in order to carry out their professional duties or to a temporary work location.

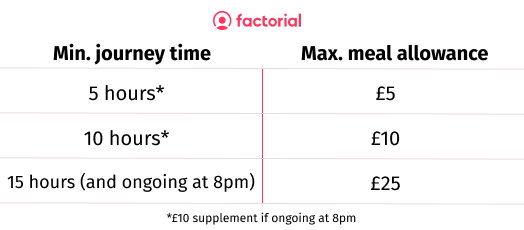

- The employee has not been at their usual work location for more than either 5 hours or 10 hours.

- The meal costs or accommodation expenses were met once the travel had begun.

Types of Per Diem Allowances

Per diem allowances for incidental expenses during business trips come in two forms:

- Companies that require a lot of travel. In this instance, you can contact the HMRC and put forward your case for a custom scale rate. This would mean your diem payments would be typically higher than the standard rates. To be successful, you need to show that your business relates travel expenses are above average.

- Companies that occasionally require travel. For these companies, per diem allowance covers the average employee expenses whilst travelling. They can use the HMRC benchmark scale rates which are listed below, which vary for foreign locations.

National Per Diem Rates UK

Here are the per diem rates (also known as scale rate payments or meal allowance rates) for employees travelling within the UK. It’s important for both employers and employees to know what the national meal allowance is in the UK in order to financially prep for this business trip. Employers must add this additional cost to the company’s overall expenses while the employee must be financially savvy with their pier diem.

International Per Diem Rates

If an employee travels outside the UK, check the per diem expenses for overseas travel. Additionally, the table below shows meal allowance rates per city for a normal working day. It includes frequent business travel destinations including the USA and Germany. It also lists the per diem rate for stays over 24 hours which covers lunch, dinner, drinks, and public transport to work.

Listed below are also the subsidised meal allowance rates and room rates for UK’s top business travel destinations. Please note that the values in the tables below are in USD.

United States

| City | Over 5 hours | Over 10 hours | 24-hour rate | Room Rate |

| Atlanta | 30.50 | 75 | 98.50 | 127 |

| Boston | 32 | 76.50 | 97.50 | 239 |

| Chicago | 34.50 | 84 | 112.50 | 198 |

| Houston | 24 | 66.50 | 88 | 113.50 |

| Los Angeles | 28.50 | 72 | 93 | 193 |

| Miami | 28 | 75.50 | 98.50 | 221.50 |

| New York | 31 | 76.50 | 102.50 | 216 |

| San Francisco | 21 | 71.50 | 99.50 | 190.50 |

| Seattle | 24.50 | 62 | 81 | 184 |

| Washington D.C. | 30.50 | 70.50 | 91.50 | 177 |

France

| City | Over 5 hours | Over 10 hours | 24-hour rate | Room Rate |

| Lyon | 28 | 73 | 79.50 | 122 |

| Marseilles | 28.50 | 86 | 92.50 | 190.50 |

| Paris | 40 | 86.50 | 117 | 199.50 |

| Strasbourg | 24 | 59.50 | 80.50 | 108 |

Spain

| City | Over 5 hours | Over 10 hours | 24-hour rate | Room Rate |

| Barcelona | 28 | 76 | 101.50 | 176 |

| Madrid | 32 | 86 | 114.50 | 172.50 |

Germany

| City | Over 5 hours | Over 10 hours | 24-hour rate | Room Rate |

| Berlin | 22 | 65.50 | 72 | 167.50 |

| Dusseldorf | 23 | 59 | 66 | 110.50 |

| Munich | 29 | 73 | 79.50 | 147 |

Netherlands

| City | Over 5 hours | Over 10 hours | 24-hour rate | Room Rate |

| Amsterdam | 25 | 65 | 72 | 150 |

| The Hague | 29.5 | 87.50 | 117.50 | 163.50 |

Internal Revenue Service Exceptions

According to HMRC, tax subsidies for meals that aren’t on a reasonable scale or are provided in a restaurant are unlikely to be exempt. Besides, you must consider which employees will be benefitting, as it won’t be considered a business expense if it’s restricted to a certain group of staff members.

Keep in mind that you cannot include vouchers exchangeable for money as business expenses on your reports. If you offer such vouchers, they do not qualify for expense reporting.

If your employees are working under a salary sacrifice or flexible remuneration arrangements (such as a zero-hour contract), meals are not exempt from taxes and can’t be considered business expenses.

Managing Expenses and Diem Payments with Factorial

Using the right tools and software can help to facilitate your expense policy and create a streamlined process for managing your expense requests, records and reports.

With Factorial’s expense management software:

- Employees can automatically upload their expenses and receipts and classify expenses according to categories.

- Managers can review expenses in their own time and accept or deny reimbursement requests.

- HR or finance can automatically generate expense reports, filter expenses and gain valuable insight into where money is being spent.

Centralising these tools makes it easier to track and manage your employee expenses. The software gives you increased visibility and data to improve the accuracy of your expense reporting so that you don’t lose out on when it comes to tax.

Plus, Factorial Cards go that one step further. These are corporate expense cards that your employees can use to manage their expenses and benefits. Each payment made with the card is automatically recorded in the app. This allows the administrator to approve or reject the request instantly.

Scale Rate Payments in Ireland

Employee benefits in Ireland are usually subject to income tax, including benefits-in-kind. These benefits have monetary value even though they cannot be converted to cash. Examples include access to a company car or accommodation.

Remote work or teleworking most often implies using a computer to work from home. This as well as other relater computer equipment are not considered benefits-in-kind as long as they are primarily used for business purposes.

Non-taxable Meal Allowance

Similarly to the UK, if the company provides a staff canteen with free or subsidised meals, which are available to all of your employees, then these meals are not subject to tax. If they are, however, only offered to certain employees then they are taxable.

Seasonal parties, entertainment expenses, and special occasion meals are not taxable if the costs are reasonable. This also applies to inclusive events and sports days.

Taxable Meal Allowance

You may also provide meal vouchers which are taxable Benefit in Kind (BIK). As in the case of only offering canteen to set employees, the employees must pay Pay as You Earn (PAYE), Pay Related Social Insurance (PRSI), and Universal Social Charge (USC). The amount is based on the value of the benefit which is the face value of the benefit or voucher less 19c.