Suppose you’re still manually managing expenses at your company. In that case, you’re most likely tired of the mountains of paper receipts growing on your desk, waiting long periods of time for reimbursements and enduring the painful process of settling accounts.

Digitising the process with expense management software removes the hassle and headaches from expense approvals and repayments. From taking clients out to dinner to riding an early-morning cab to the airport, employees can quickly upload receipts that managers can review instantly.

The hard part? Knowing which solution works best and is most suited to your company. In this post, we’ve rounded up the top 6 digital solutions, listing the pros and cons of each, so that you can start streamlining your expense management by the time you’ve finished reading this article.

Contents

- What is an Expense Management Software?

- Benefits of Having a Financial Management Software

- How Do I Choose a Financial Management Software?

- 1: Factorial ⭐⭐⭐⭐⭐

- 2: BreatheHR ⭐⭐⭐⭐

- 3: Workday ⭐⭐⭐

- 4: Access People HR ⭐⭐

- 5: Soldo ⭐⭐⭐

- 6: Pleo ⭐⭐⭐⭐

- 7: Yokoy ⭐⭐⭐

- 8: Precoro ⭐⭐⭐

- 9: SAP Concur ⭐⭐⭐

- 10: Zoho ⭐⭐⭐⭐

- 11: Spendesk ⭐⭐⭐

What is an Expense Management Software?

An Expense Management Software is a digital tool enabling employees to effortlessly upload and categorise their expenses and receipts to one centralised system. Managers have the flexibility to review expenses instantly and to either approve or reject reimbursement requests at the click of a button.

The best types will also allow HR or managers to automatically generate detailed expense reports, apply filters to expenses, and extract valuable insights regarding expenditure patterns.

Having all these tools consolidated in a single platform simplifies the tracking and management of business expenses. It also provides enhanced visibility and data analytics capabilities, ultimately leading to more accurate expense reporting and ensuring compliance with tax regulations.

Benefits of Having a Financial Management Software

Manual expense management has plenty of downfalls, largely due to the risk of human error and the time taken for finance teams and managers to process approvals and reimbursements. Yet, most of these can be remedied by implementing a Financial Management Software, which can improve the following:

- Cost Control: Helps in monitoring and controlling expenses, reducing unnecessary spending, and improving budget management.

- Time Efficiency: Streamlines the expense reporting process, saving time for employees and finance teams by automating tasks like data entry and approval workflows.

- Accuracy: Minimises human errors and ensures accurate expense tracking and reimbursement calculations.

- Compliance: Ensures adherence to company expense policies and regulatory requirements, reducing the risk of non-compliance.

- Transparency: Provides real-time visibility into expenses, enabling better decision-making and forecasting.

- Cost Savings: Identifies cost-saving opportunities by analysing expense data and trends.

- Paperless Workflow: Reduces the need for paper receipts and manual paperwork, contributing to environmental sustainability.

- Employee Satisfaction: Speeds up reimbursement processes, leading to happier employees.

- Mobile Accessibility: Allows employees to submit expenses and receipts on-the-go, improving convenience.

- Reporting and Analytics: Generates reports and analytics to give deeper insights into company spending and improve financial planning.

- Integration: Seamlessly integrates with accounting and ERP systems, streamlining financial operations.

- Fraud Prevention: Detects fraudulent expenses and enhances security measures.

How Do I Choose a Financial Management Software?

There are lots of factors to take into consideration when deciding between different types of Financial Management Software. Companies need to carefully weigh up the criteria to make an informed decision. Follow these steps to find the right fit for your team and avoid integration issues further down the line:

- Needs Assessment: Begin by outlining your organisation’s specific needs and goals, such as expense volume, reporting requirements, and integration with existing systems.

- Research: Research different expense management software options, considering factors like features, pricing, user-friendliness, and customer reviews. Perhaps create a comparison table for visibility!

- Demo and Trial: Request demos and free trials to get a hands-on experience with the software, evaluating how well it aligns with your needs.

- Cost Analysis: Assess the total cost of ownership, including subscription fees, implementation, and ongoing support costs.

- Integration Capability: Ensure the software can seamlessly integrate with your accounting and ERP systems.

- User Training: Evaluate the training and onboarding resources offered by the software provider.

- Support and Updates: Consider the level of customer support and the frequency of software updates.

- Security and Compliance: Verify that the software meets security standards and regulatory requirements.

- Scalability: Choose a solution that can grow with your organisation’s evolving needs.

- Stakeholder Input: Gather input from key stakeholders within your organisation to make an informed decision. The decision will impact multiple teams so it’s important to get as many opinions as possible!

1: Factorial ⭐⭐⭐⭐⭐

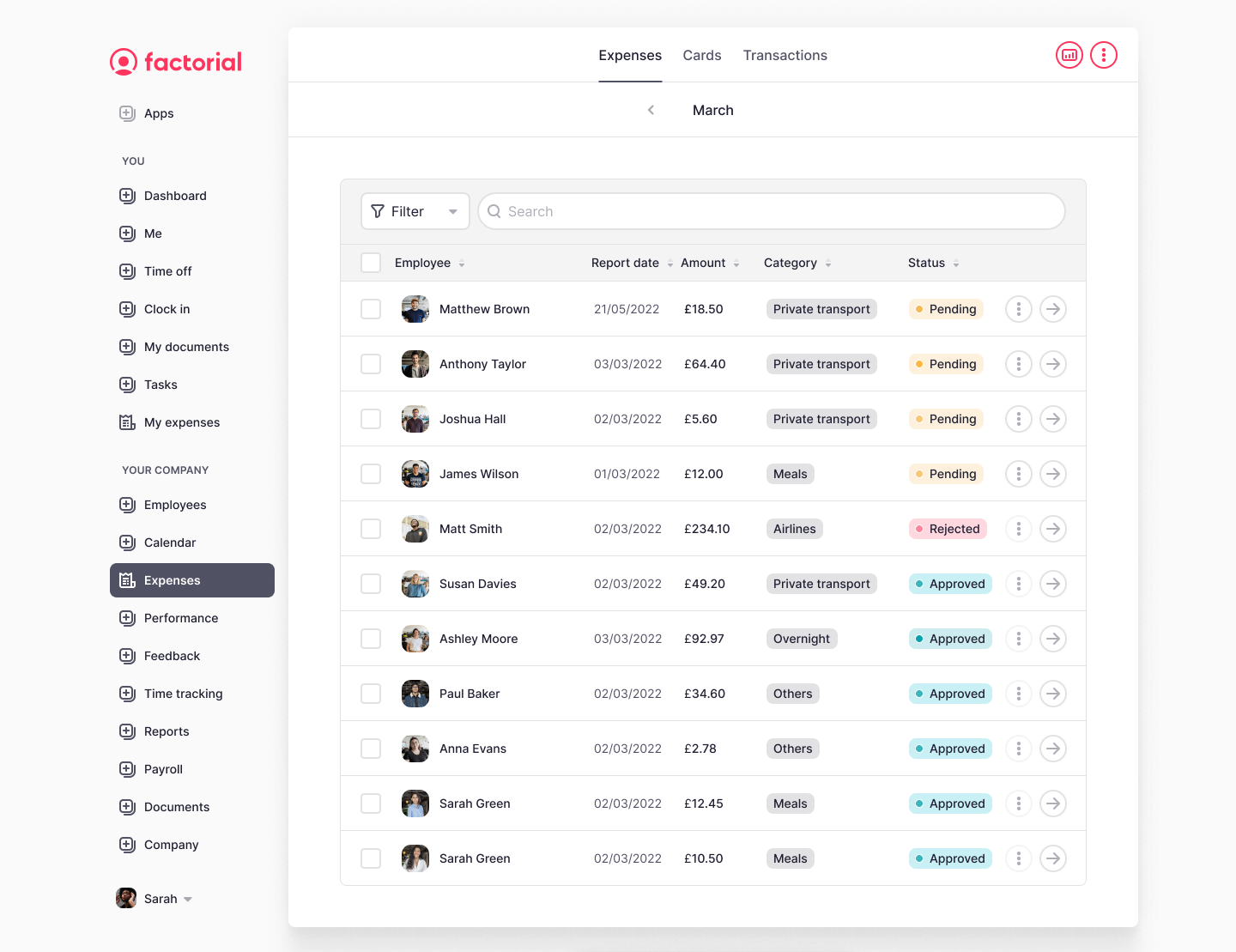

Factorial is a powerful and user-friendly all-in-one HR platform including Expense Management Software. This solution allows you to streamline the expense approval and reimbursement processes, empowering companies to control their expenditures and save money in the long run. It offers features such as expense request workflows, categorisations, reporting and business expense cards. On average, this tool saves organisations 10 minutes per ticket submitted to spend on more impactful, strategic tasks.

Factorial also offers additional HR tools, making it a comprehensive solution for managing the employee lifecycle from start to finish. These include document management and e-signature, time tracking, absence management, performance management and more. With its intuitive interface and customisable bundles, this platform is a strong choice for businesses searching for a standalone Expense Management Solution or an all-in-one HR solution.

Pros

✅ Free demo and 14-day free trial

✅ Efficiency: Employees and administrators save time with Factorial’s efficiency in expense submission, approval, and reporting.

✅ Cost Control: A real-time spend analysis helps businesses identify where to invest and control expenses.

✅ Transparency: A clear view of financial resource utilisation improves transparency and control.

✅ Employee Empowerment: Reduce administrative workload by allowing employees to track their own expenses and view approval status.

✅ Integration: Factorial’s integrated HR and expense management solution offers a range of features and integrations.

✅ Business pre-paid expense cards available and integrated with Expense Management tool.

Cons

❌ Unable to solely use Expense Management tool – must choose a bundle.

❌ Technical expertise may be necessary to integrate with existing systems.

❌ Time-consuming to customise platform to meet specific organisational needs.

Hear what our happy customers have to say about the platform.

Pricing

Finance hub starts at £35/month (Billed annually): 10 users included

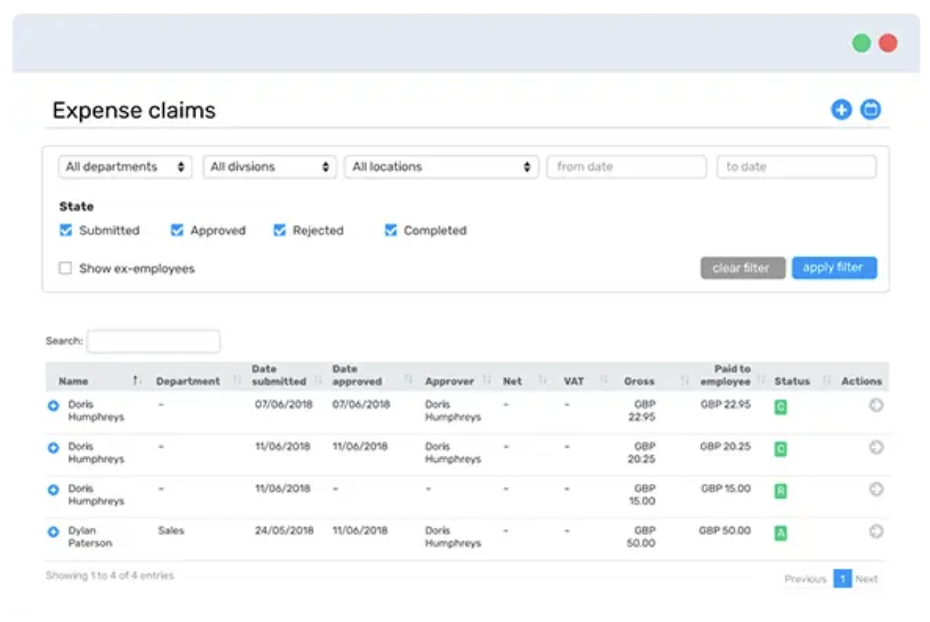

2: BreatheHR ⭐⭐⭐⭐

BreatheHR is a comprehensive HR software designed for small and medium-sized businesses. Their platform supports companies with their day-to-day HR tasks by centralising employee data, documentation and processes. Their tools range from recruitment and performance to expense tracking and time & attendance.

Pros

✅ Instant approvals or rejections.

✅ Receipt information taken from photos and automatically inputted in system.

✅ Connect expenses to specific projects or clients.

✅ Expenditure reports.

Cons

❌ Expense cards not available.

❌ Unable to solely use Expense Management tool – must choose a bundle.

❌ Technical expertise may be necessary to integrate with existing systems.

❌ Less intuitive interface.

Pricing

From £18 per month, per business: 1-10 employees

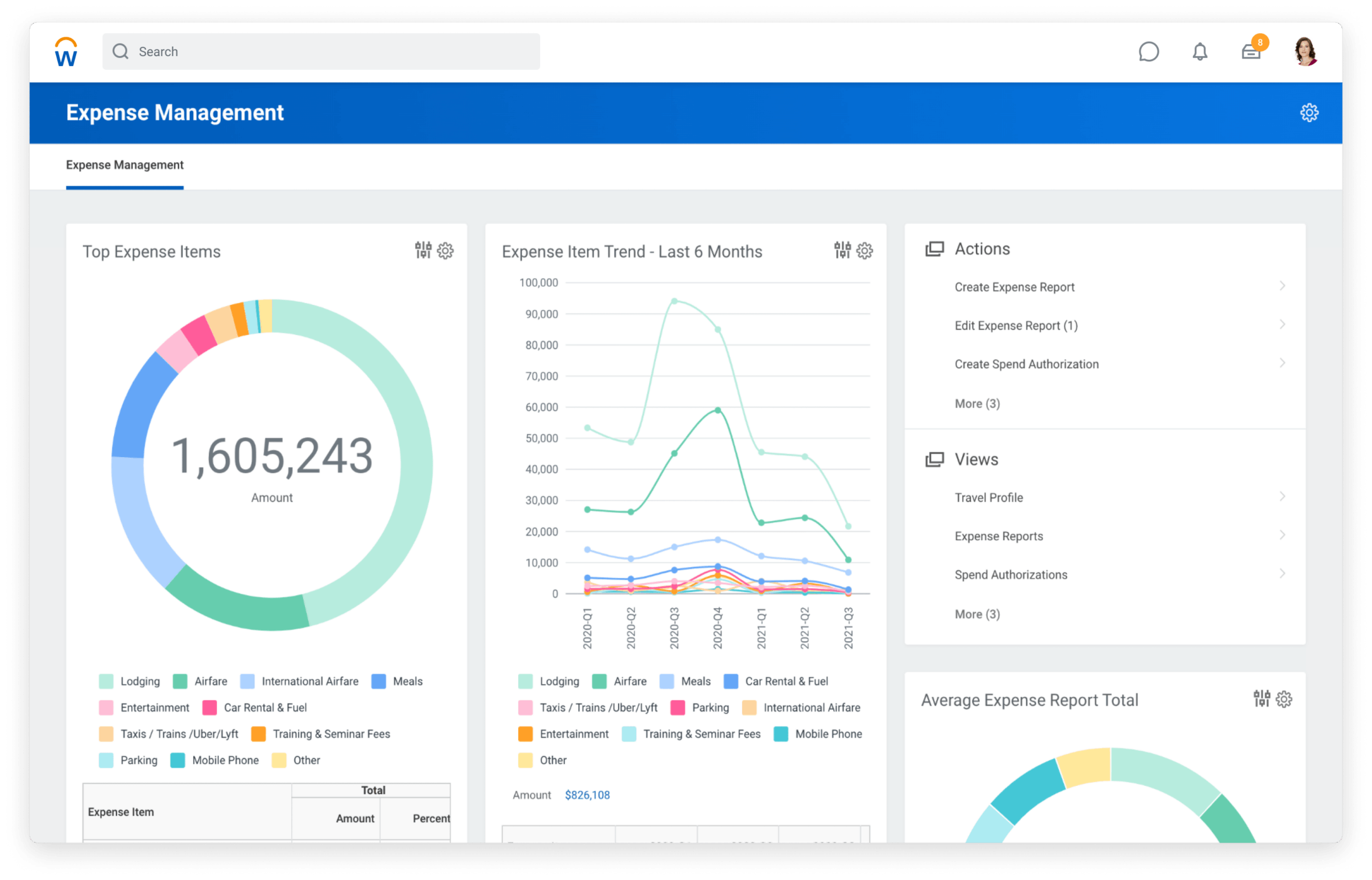

3: Workday ⭐⭐⭐

Workday HCM is a cloud-based solution that facilitates workforce planning and payroll processing; their tools mostly support finance and talent management. The platform is largely powered by AI and machine learning and is aimed at helping medium-sized to large companies.

Pros

✅ Instant approvals or rejections.

✅ User-friendly and informative expense reports with deep analysis.

✅ Receipt information taken from photos and automatically inputted in system.

✅ Uses machine learning to calculate risk scores so managers can easily investigate items.

Cons

❌ Expense cards not available.

❌ Sometimes expenses are “glitchy” and some of the fields are unclear.

❌ Creating expense reports is not always user-friendly and can take a while to get used to. The system can be slow and it’s difficult to input new data.

❌ Cannot create expense reports with unlimited items.

❌ Cannot add multiple approvals within departments before final approval.

❌ Limit on number of expense reports available.

Pricing

Contact the Workday sales team for a quote.

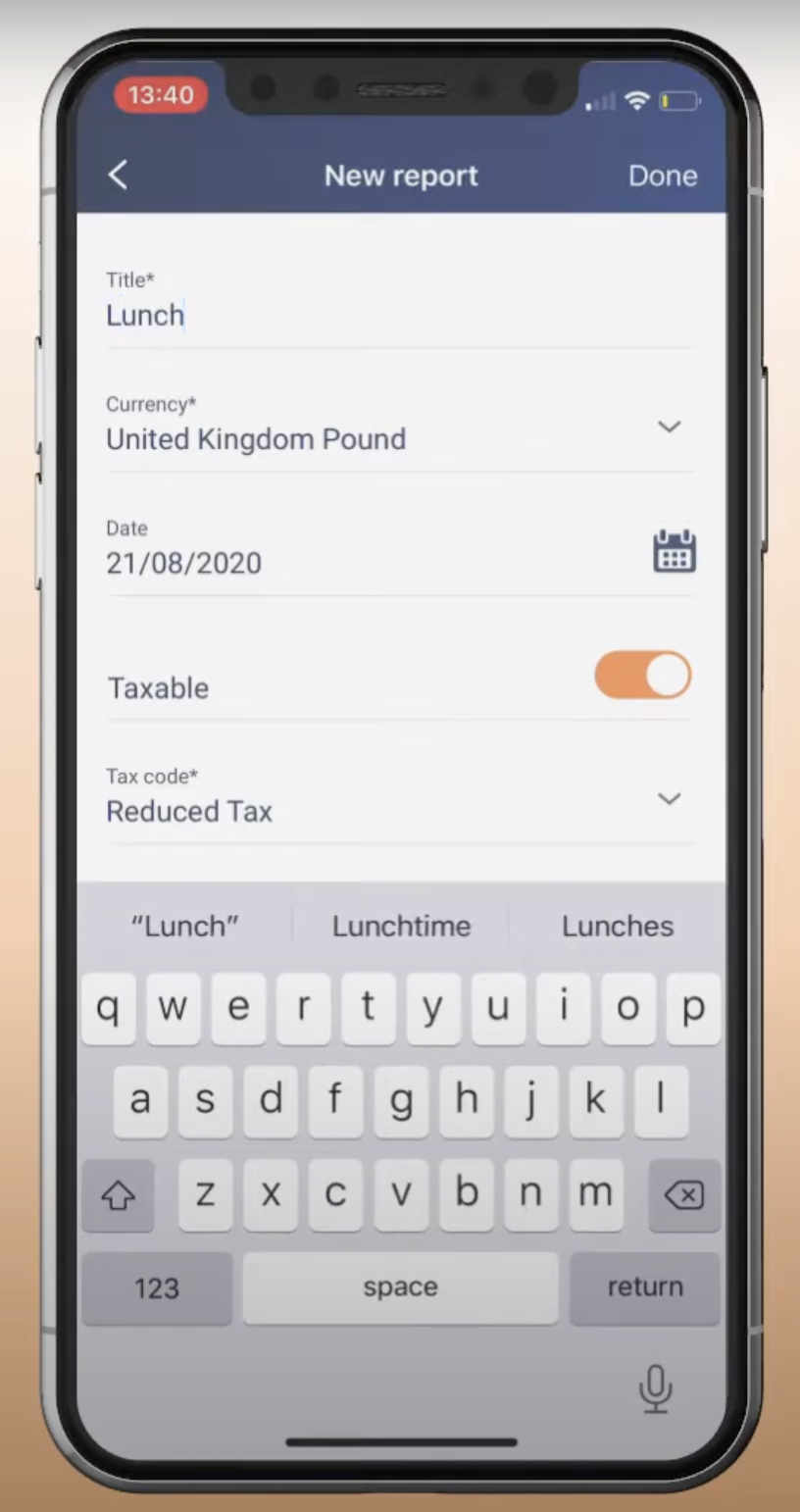

4: Access People HR ⭐⭐⭐

Access People HR is an all-in-one HR software designed for small to mid-sized companies. It covers all of the main HR processes, including talent acquisition, performance management, payroll, and time & attendance. It centralises employee documentation and personal information to digitise and streamline people management and reduce paperwork.

Pros

✅ Employees can submit expense reports.

✅ Expense management tool available in app so employees can easily upload receipts and submit reimbursement claims.

Cons

❌ Expenses section is an additional tool that needs to be added on to the other functionalities.

❌ Expense tool is glitchy. Users have spent a lot of time speaking to the helpdesk and in some cases have given up trying.

❌ Must manually enter the details for each expense. The tool does not automatically upload information based on receipts.

❌ Expenses module only available via mobile app.

Pricing

From 10.45 MYR per employee per month.

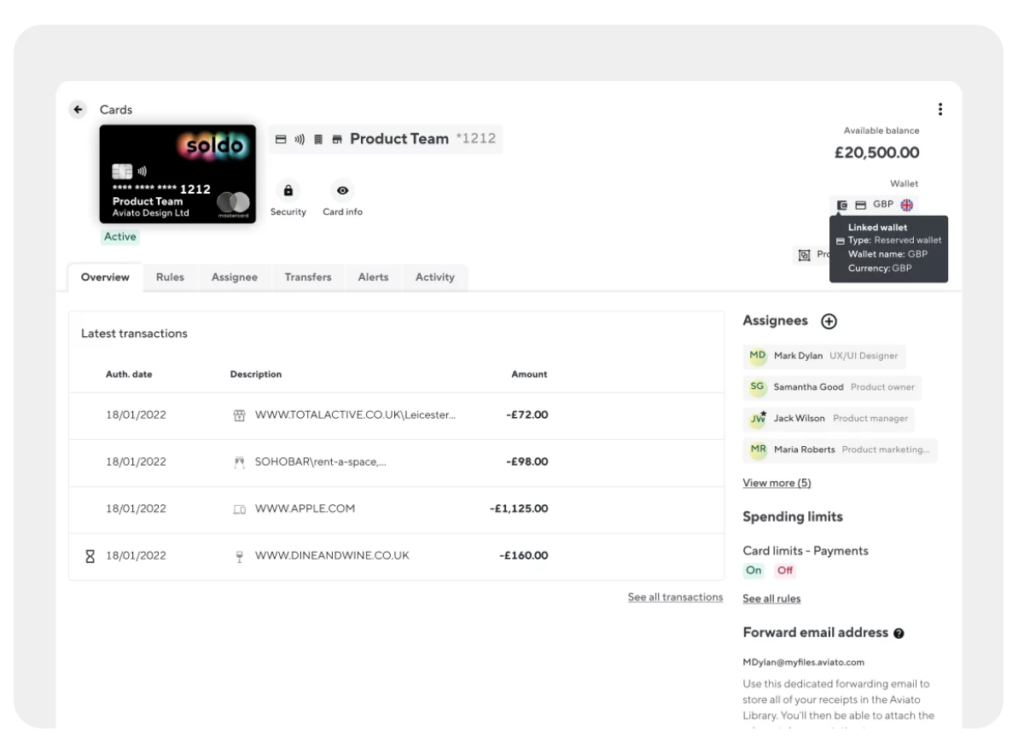

5. Soldo ⭐⭐⭐

Soldo is revolutionising expenses by combining company cards with its management platform. Employees no longer need to use their own money, effectively eliminating the hassle of dealing with missing receipts while giving finance teams better control over company spending.

The service equips employees or teams with Soldo cards and allows managers and financial controllers to set spending rules. Soldo is simplifying expenses for businesses of all sizes across Europe, offering scalable solutions for even the most complex organisational structures and tech setups.

Pros

✅ Quick and easy setup and accessibility for users via browser and app.

✅ Excellent user experience

✅ Helpful and clear reporting functions

✅ Outstanding customer service for quick issue resolution

Cons

❌ Paying per card rather than per user can result in unnecessary expense management.

❌ Lack of account management functionality on the app

Pricing

Starts at £6.00 per user per month.

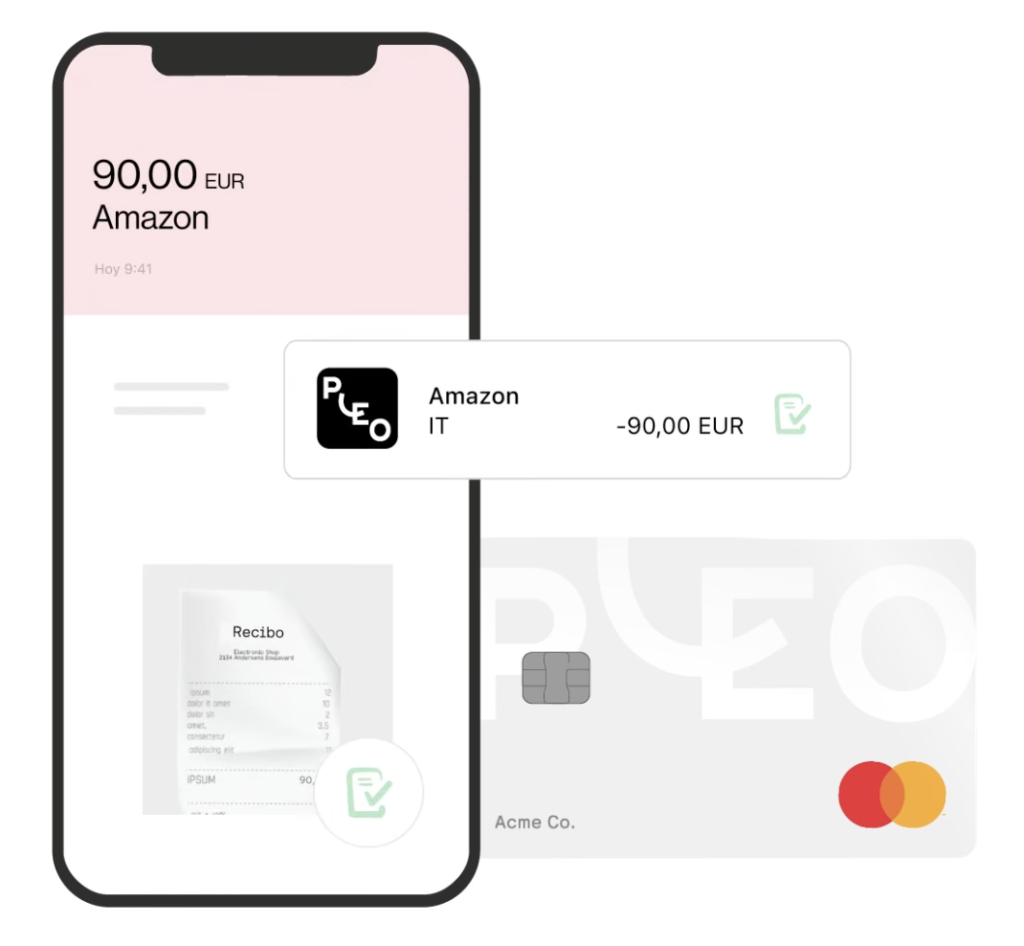

6. Pleo ⭐⭐⭐⭐

Pleo is a leading expense management solution in Europe. It streamlines expenses for businesses by offering smart company cards to employees and keeping track of receipts. With Pleo, companies gain real-time expense visibility and automated expense management while also reducing administrative work.

Over 20,000 companies use Pleo to control their expense reports and receipts, set individual spending limits, and offer real-time purchase tracking. It empowers teams and eliminates the need for reimbursements, saving Pleo admins up to 138 hours annually.

Pros

✅ Easy to use with simple yet detailed categories

✅ Comprehensive toolbox for managing receipts

✅ 24/7 customer support

✅ Seamless integration with accounting software

Cons

❌ Challenges arise when handling a backlog of invoices, especially if left until month-end.

❌ Room to improve the onboarding process to improve user confidence.

❌ Lack of feedback when submitting receipts

Pricing

Pleo has three pricing options ranging from $0 to $65. Start for free for up to three users.

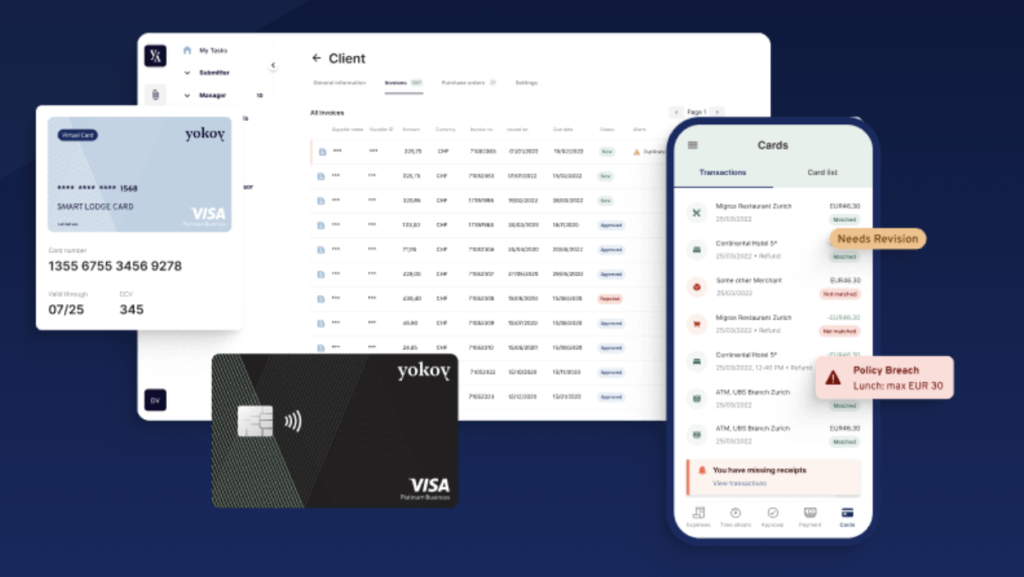

7. Yokoy ⭐⭐⭐

Yokoy is an innovative business spend management solution designed for medium to large enterprises. It offers data-driven insights on expense management, invoice processing, and smart corporate cards in one user-friendly platform.

Yokoy uses artificial intelligence to enhance spending transparency and control. It’s beneficial for companies with 200+ employees who have reported a time saving of up to 90% on expense management, corporate cards, and supplier invoices. Yokoy’s comprehensive solution is available in over 150 countries and languages, making it the go-to choice for streamlining spend management processes worldwide.

Pros

✅ User friendly

✅ Cost-effective – users report a 20%-30% reduction in subscription spending

✅ Intelligent receipt reading, foreign currency management, and credit card integration

✅ Powerful AI features and seamless ERP integration

Cons

❌ Virtual cards don’t link to Apple Pay

❌ Issues with the ‘Submitters’ search function

❌ Absence of certain filter functions

❌ Challenges in managing client expenses because the platform lacks a direct expense-to-client linking option

Pricing

Contact Yokoy for current pricing.

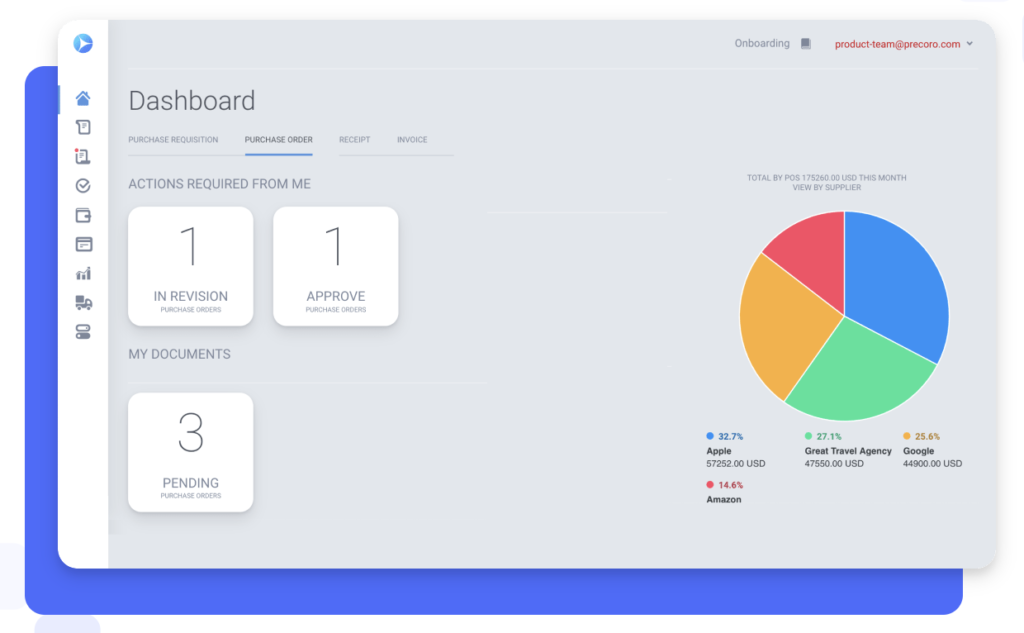

8. Precoro ⭐⭐⭐

Precoro is a cloud-based procurement optimisation solution that automates and simplifies the purchasing process. It offers benefits such as:

- Faster document approval with email and Slack notifications.

- Savings of up to 19% on your purchasing budget.

- Enhanced transparency in cash flow and corporate expenses.

- Reduction in manual data entry.

- Integration with ERPs and other business tools.

- Robust security with SSO and 2-factor authentication.

Precoro is designed for businesses of all sizes, from SMBs to large enterprises across various industries. Its user-friendly interface, regular updates, and a 14-day free trial make it a valuable tool for streamlining procurement and improving spending visibility and compliance.

Pros

✅ Quick and helpful report creation

✅ Effective support from the Precoro team

✅ User-friendly and easy to implement, especially for non-finance managers

✅ Valuable search function for finding other users’ POs and integration with QBO

Cons

❌ System glitches sometimes require a restart

❌ Budget tracking challenges when relying on paper-based systems

❌ Difficulty in supplier interaction due to the platform’s lack of account management

Pricing

Precoro has two pricing editions starting at $35 per user.

9. SAP Concur ⭐⭐⭐

SAP Concur is a leading integrated travel, expense, and invoice management solutions provider. Its top-rated app guides employees through trip planning, seamlessly populates expenses into reports, and automates invoice approvals.

By utilising near real-time data and AI-powered auditing, SAP Concur ensures businesses have complete visibility over their spending. It goes beyond automation to offer a fully connected spend management solution that includes travel, expense, vendor invoice, compliance, and risk management, catering to a wide range of businesses, from small businesses to Fortune 500 companies. It’s a versatile tool that can scale with your business’s needs by providing powerful insights and reducing complexity in spending management.

Pros

✅ Great electronic expense submission and automation – particularly with automatic payments

✅ Administrator-friendly

✅ Easy to use with excellent functionality

✅ Convenient personal mileage tracking with integrated map

Cons

❌ Onboarding issues

❌ Challenges with rectifying errors – users report having to start the process again

❌ Customer service has room for improvement

Pricing

SAP Concur ‘Automate’ starts at $9 per report.

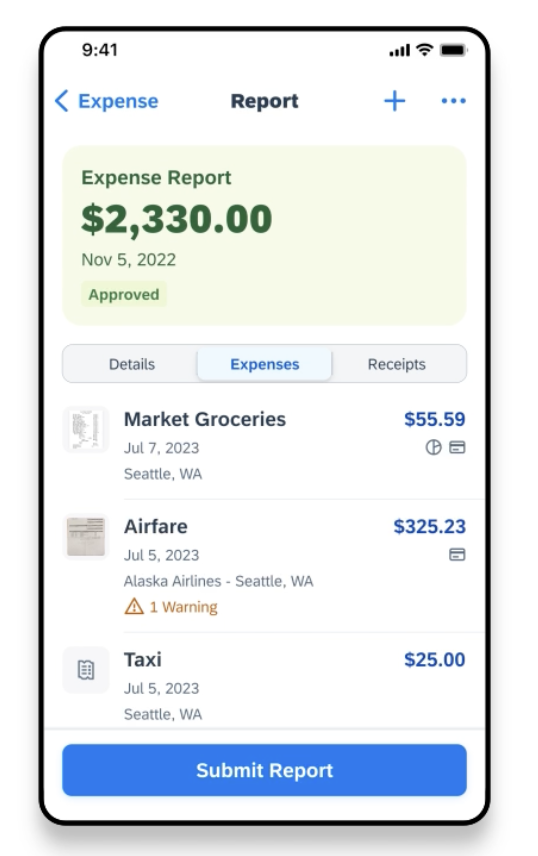

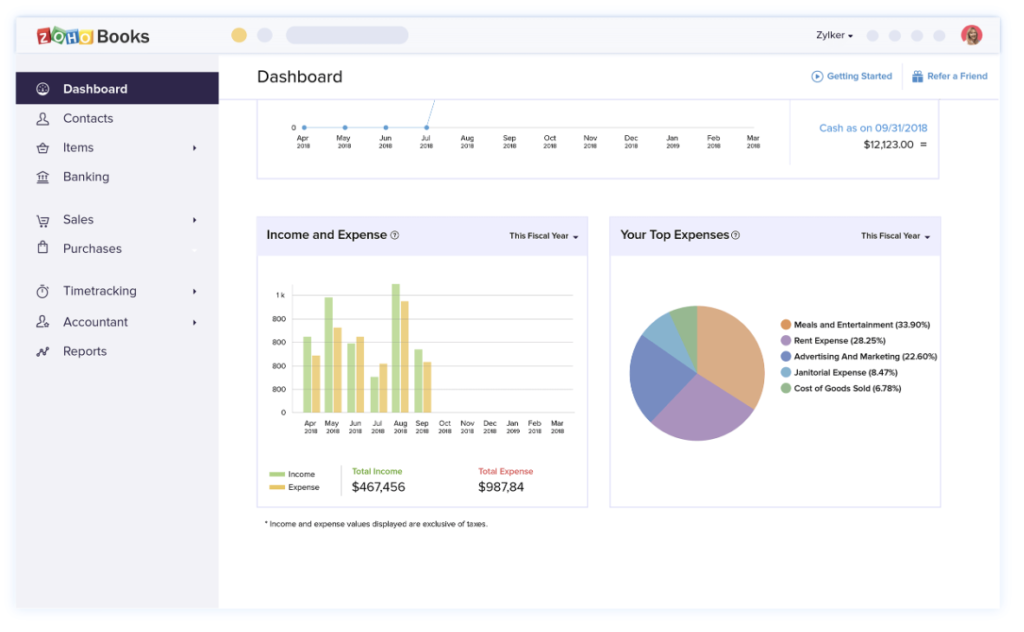

10. Zoho ⭐⭐⭐⭐

Zoho Expense is a comprehensive travel and expense management tool designed to streamline corporate travel, automate expense reporting, and enhance control over spending. It focuses on reducing overspending, minimising manual intervention, and preventing policy breaches and fraudulent claims.

Zoho Expense offers businesses in over 150 countries insights into discretionary spending to boost productivity, cash flow, and financial health by providing expense report submission, approvals, compliance, fraud detection, card reconciliation, and expense accounting all in one place. It seamlessly integrates with existing workflows and allows a high level of customisation to align with an organisation’s processes. Zoho Expense mainly targets mid-market and large enterprises.

Pros

✅ User-friendly interface

✅ Fast implementation

✅ Flexible and customisable platform

Cons

❌ Steep learning curve

Pricing

Zoho Expense has four pricing options, from $0 to $8. A free trial is also available for up to three users.

11. Spendesk ⭐⭐⭐

Spendesk is a comprehensive spend management platform offering a 7-in-1 solution for businesses. It includes corporate cards, invoice payments, expense reimbursements, budgets, approval workflows, reporting, compliance, and pre-accounting in one user-friendly and scalable system.

Trusted by a diverse range of businesses, from startups to established brands, Spendesk prioritises saving time and money throughout the entire spending process. With its 100% spend visibility, automation, and streamlined approval process, Spendesk empowers every employee to take financial responsibility for their company. Additionally, Spendesk simplifies company travel by enabling secure online payments with virtual cards and smart debit cards and efficient invoice processing.

Pros

✅ Quick and easy navigation

✅ Simple expense uploads and approvals

✅ Friendly and accessible customer support

✅ Regularly adds new features and enhances existing ones

Cons

❌ Inconsistent functionality

❌ Lack of clear payment processing timeline

❌ Unable to support multiple individual charges with one Spendesk card

❌ Occasional compatibility issues

Pricing

Spendesk has three pricing options, including a free trial. Contact them for a custom quote.

The information presented on this page is based on publicly available sources and not limited to breathhr.com, workday.com, soldo.com, pleo.io, sap.com, zoho.com, spendesk.com, Capterra public reviews, G2 public reviews, and trustpilot public reviews. The comparisons between Factorial and other providers, are intended solely for the illustration of the respective software features, pricing and functionalities. All information regarding features, prices, and integrations may be subject to change without prior notice. Factorial assumes no liability for the accuracy, completeness, or timeliness of the information presented. We recommend contacting the respective providers directly to obtain the most accurate and up-to-date information. All legal regulations regarding spanish fair advertising and competition law are fully observed by us; if you have any concerns, please reach out to us. The comparisons presented do not constitute a final evaluation or recommendation for any provider, but serve solely as an informational source.